Onstream Media Corporation Reports Fiscal 2010 -- Generates $188,000 in Positive Cash Flow from Operating Activities (Before Changes in Working Capital) For the Quarter, Debuts MarketPlace365™ -- POMPANO BEACH, FL, August 16, 2010 - Onstream Media Corporation ( OTC: ONSM), an online service provider of live and on-demand internet video, announced today financial results for its third quarter of fiscal 2010 as well as the nine month fiscal year to date period ended June 30, 2010. Financial Highlights

Operational Highlights

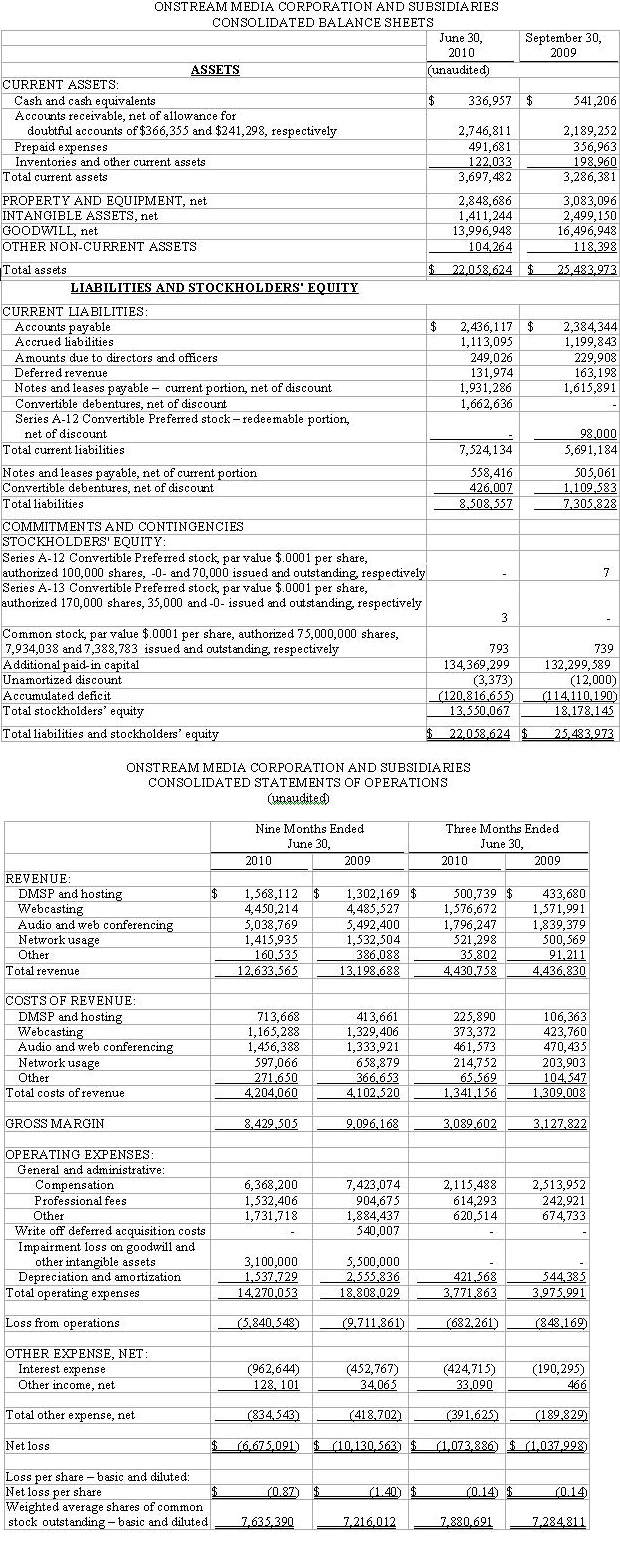

Financial Discussion Revenues for the third quarter of fiscal 2010 were approximately $4.4 million representing a 7.2% sequential increase compared to revenues of approximately $4.1 million in the second quarter of fiscal 2010, and essentially flat compared to revenues for the third quarter of fiscal 2009. However, Onstream recorded an approximately $67,000, or 15.5%, net increase in DMSP and hosting division revenues for the third quarter of fiscal 2010, as compared to the corresponding period of the prior fiscal year, as this division continued its previous growth over the prior year numbers during this fiscal year. Gross profit for the third quarter of fiscal 2010 was approximately $3.1 million compared sequentially to gross profit of approximately $2.7 million for the second quarter of fiscal 2010 and compared to approximately $3.1 million in the year-ago quarter. This represents gross margin percentages of 69.7% of revenues for the third quarter of fiscal 2010, 64.8% of revenues for the second quarter of fiscal 2010 and 70.5% of revenues for the year-ago quarter. Total operating expenses for the third quarter of fiscal 2010 were approximately $3.8 million, down 5.1% from approximately $4.0 million for the third quarter of fiscal 2009. This decrease was primarily the result of a decrease in compensation expense of approximately $398,000 as compared to that expense for the corresponding period of the prior fiscal year. Effective October 1, 2009, a significant portion of Onstream's workforce, including all of management, took a 10% payroll reduction, which management expects will be maintained until increased operating cash flows are sufficient to cover capital expenditures and debt service. This 10% payroll reduction is the primary reason for the decreased compensation expense for the third quarter of fiscal 2010 versus the corresponding prior year period. The consolidated net loss for the three months ended June 30, 2010 was approximately $(1.1) million, or $(0.14) loss per share (based on 7.9 million weighted average shares outstanding, accounting for the 1-for-6 reverse stock split), as compared to a loss of approximately $(1.0) million, or $(0.14) loss per share (based on 7.3 million weighted average shares outstanding, adjusted to account for the 1-for-6 reverse stock split) for the prior-year third quarter. The consolidated net loss for the three months ended June 30, 2010 of approximately $(1.1) million included non-cash expenses of approximately $1.3 million, including depreciation and amortization as well as employee compensation, professional fees and interest paid with shares and options. Accordingly, Onstream generated approximately $188,000 positive cash flow from operating activities (before changes in current assets and liabilities) for the third quarter of fiscal 2010, as compared to approximately $91,000 for the same period last year. For the nine months ended June 30, 2010, Onstream's total revenue decreased 4.3% to approximately $12.6 million as compared to approximately $13.2 million for the same period of the prior year. However, during the nine months ended June 30, 2010 Onstream recorded an approximately $266,000 (20.4%) net increase in DMSP and hosting division revenues over the same period of the prior fiscal year. This increase in DMSP and hosting division revenues included (i) an approximately $53,000 increase in DMSP "Store and Stream" and "Streaming Publisher" revenues and (ii) an approximately $213,000 increase in hosting and bandwidth charges to certain larger DMSP customers serviced by our Smart Encoding division. Gross margin for the nine months ended June 30, 2010 was approximately $8.4 million, representing 66.7% of revenues, compared to approximately $9.1 million, representing 68.9% of revenues, for the same period in the prior year. Total operating expenses decreased 24.1% to approximately $14.3 million for the nine months ended June 30, 2010, compared to $18.8 million for the same period in the prior year. The net loss for the nine-month fiscal period was approximately $(6.7) million, or $(0.87) loss per share (based on 7.6 million weighted average shares outstanding, accounting for the 1-for-6 reverse stock split) compared to a net loss of approximately $(10.1) million, or $(1.40) loss per share (based on 7.2 million weighted average shares outstanding, accounting for the 1-for-6 reverse stock split) for the same fiscal period in the prior year. The nine-month fiscal 2010 net loss included a $3.1 million charge for impairment of goodwill and other intangible assets and in the fiscal year 2009 period, the net loss included a $5.5 million charge for impairment of goodwill and other intangible assets as well as a $540,000 write off on deferred acquisition costs. The consolidated net loss for the nine months ended June 30, 2010 of approximately $(6.7) million included non-cash expenses of approximately $6.4 million, including the goodwill impairment charge discussed above, plus depreciation and amortization as well as employee compensation, professional fees and interest paid with shares and options. Accordingly, Onstream utilized approximately $256,000 in cash for operating activities (before changes in current assets and liabilities) for the first nine months of fiscal 2010, as compared to approximately $275,000 in cash used for operating activities for the same period last year. Onstream had cash of approximately $337,000 on its balance sheet as of June 30, 2010. Outlook Randy Selman, President and Chief Executive Officer of Onstream Media, commented, "We were pleased that we were able to generate $188,000 in cash flow from operating activities (before changes in working capital) for the quarter ended June 30, 2010, which was more than double the $91,000 that we generated in the comparable quarter in 2009. This improvement was primarily a result of our focus on managing expenses, although we were also glad to see that sales showed modest improvement across practically all our product offerings as the economy improved and we returned to prior year sales levels." Mr. Selman continued, "I believe that our MarketPlace365 platform represents a game-changing technology, and this belief was reinforced in July as SUBWAY became our first customer to utilize this unique platform to connect vendors and their franchisees. A virtual webinar in August, that Onstream co-hosted and in which I participated, revealed some compelling statistics from an on-line survey that we jointly conducted with TSNN about the virtual trade show market, including the finding that 75% of the survey responders see virtual tradeshows as an add-on or an extension to an existing show or physical event. In addition, according to a recent study by the media analyst firm Market Research Media, the virtual conference and tradeshow market is projected to become an $18 billion-plus industry in five years. We believe that this trend is being driven, in part, by a green focus as companies seek ways to reduce their carbon footprint. We remain optimistic about the potential of this product offering and believe MarketPlace365 can become a growth driver for us, starting in fiscal 2011." "We have much to be excited about as we look toward the future," concluded Mr. Selman. "We have achieved notable commercial success already for our MarketPlace365 platform and have built a robust pipeline of opportunities for additional agreements. In addition, this unique and proprietary platform utilizes other core Onstream offerings, including our iEncode 'webcast in a box' solution, as well as our DMSP and hosting services. Now that we have returned to prior year sales levels with our legacy products, we believe that continued growth of those sales as well as the additional sales opportunities resulting from MarketPlace365 will result in record revenues for Onstream in fiscal 2011." Teleconference Onstream Media will hold a conference call at 4:30 p.m. ET on Tuesday, August 17, 2010, to discuss its fiscal 2010 third quarter financial results for the period ended June 30, 2010. Interested parties may listen to the presentation live online at http://www.visualwebcaster.com/event.asp?id=71345 or by calling 1-888-645-4404 or 201-604-0169. It is recommended to dial in approximately 10 to 15 minutes prior to the scheduled start time. An audio rebroadcast of the conference call will be archived for one year online at http://www.visualwebcaster.com/event.asp?id=71345. About Onstream Media: Onstream Media Corporation ( OTC: ONSM) is a leading online service provider of live and on-demand Internet broadcasting, corporate web communications and virtual marketplace technology. Onstream Media's innovative Digital Media Services Platform (DMSP) provides customers with cost effective tools for encoding, managing, indexing, and publishing content via the Internet. The company's MarketPlace365T solution enables publishers, associations, trade show promoters and entrepreneurs to rapidly and cost effectively self-deploy their own profitable, online virtual marketplaces. In addition, Onstream Media provides live and on-demand webcasting, webinars, web and audio conferencing services. To date, almost half of the Fortune 1000 companies and 78% of the Fortune 100 CEOs and CFOs have used Onstream Media's services. Select Onstream Media customers include: AAA, Dell, Disney, Georgetown University, National Press Club, PR Newswire, Shareholder.com (NASDAQ), Sony Pictures and the U.S. Government. Onstream Media's strategic relationships include Akamai, Adobe, BT Conferencing, Qwest and Trade Show News Network (TSNN). For more information, visit Onstream Media at www.onstreammedia.com or call 954-917-6655. CONTACTS: Investor Relations: Cautionary Note Regarding Forward Looking Statements Certain statements in this document and elsewhere by Onstream Media are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such information includes, without limitation, the business outlook, assessment of market conditions, anticipated financial and operating results, strategies, future plans, contingencies and contemplated transactions of the company. Such forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors which may cause or contribute to actual results of company operations, or the performance or achievements of the company or industry results, to differ materially from those expressed, or implied by the forward-looking statements. In addition to any such risks, uncertainties and other factors discussed elsewhere herein, risks, uncertainties and other factors that could cause or contribute to actual results differing materially from those expressed or implied for the forward- looking statements include, but are not limited to fluctuations in demand; changes to economic growth in the U.S. economy; government policies and regulations, including, but not limited to those affecting the Internet. Onstream Media undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. Actual results, performance or achievements could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those set forth in Onstream Media Corporation's filings with the Securities and Exchange Commission. Tables Follow

|

###