Onstream Media Corporation Reports Fiscal 2009 Second Quarter Financial Results

POMPANO BEACH, Fla. – May 15, 2009 – Onstream Media Corporation ( OTC: ONSM), an online service provider of live and on-demand internet video, announced today its financial results for the second fiscal quarter, the three months ended March 31, 2009. Second Quarter Financial Highlights

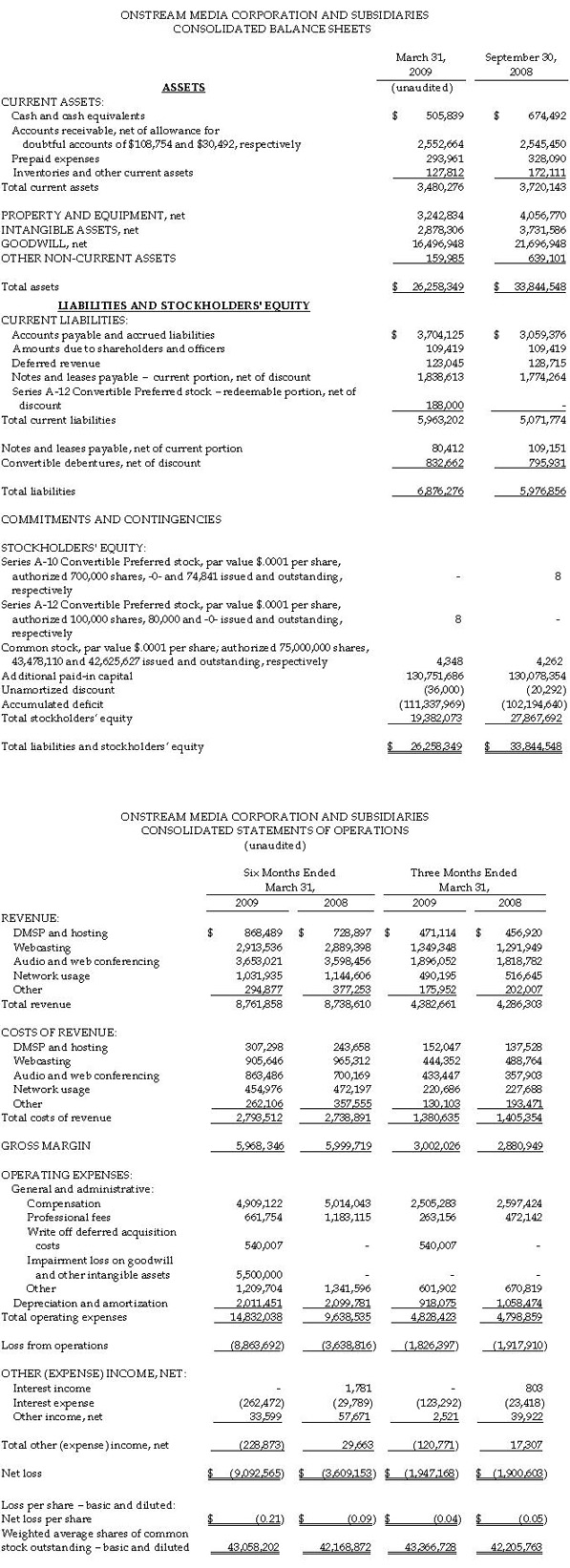

Financial Discussion Randy Selman, President and Chief Executive Officer of Onstream Media, commented, "Despite a very nervous corporate environment and volatile economy, we were able to maintain revenue levels and generate operating income during the quarter from both of our segments. Further, comparing second quarter 2009 to first quarter 2009, we showed a sequential improvement in our consolidated gross profit margin (dollars and percentage) and reduced our cash used in operating activities. Also, including the impact of our cost reductions implemented in February 2009, we generated positive cash flow from operating activities (before changes in current assets and liabilities) during the month of March. Excluding the non-cash write-down for deferred acquisition costs, we narrowed our net loss in the second quarter of 2009, as compared to the first quarter of 2009, by $493,000, or approximately 26%. Since the benefit of the salary and other cost reductions implemented starting in February did not affect the second quarter until the month of March, we anticipate that the positive operating cash flow results for March will continue through the third quarter of 2009 and the balance of the fiscal year as a whole. Combined with anticipated increases in revenue during the second half of fiscal 2009, the Company should begin to generate increasing levels of cash from operations in the coming quarters." Second fiscal quarter 2009 revenue of approximately $4.4 million reflected an increase of 2% from approximately $4.3 million for the second fiscal quarter of last year. This second fiscal quarter 2009 revenue was essentially unchanged from revenue for the first quarter of fiscal 2009. Comparing the second fiscal quarter of 2009 to the corresponding prior year period, the Company experienced increased revenues from its Digital Media Services Group, partially offset by slightly decreased revenues from the Audio and Web Conferencing Services Group, although the Company's Infinite Conferencing division recorded record revenues of approximately $1.9 million in the second fiscal 2009 quarter. Gross margin for the second fiscal quarter of 2009 was approximately $3.0 million, or 68.5% of revenues, versus $2.9 million, or 67.2% of revenues, for the comparable year-ago period. The gross profit margin on revenue related to the Infinite Conferencing division was approximately 77.1% for the fiscal 2009 second quarter and the Webcasting division contributed gross profit margin of approximately 67.1% for that same period. Total operating expenses for the second fiscal 2009 quarter were $4.8 million which included a $540,000 write off of deferred acquisition costs related to the cancelled Narrowstep acquisition. Excluding the write off, operating expenses would have been $4.3 million for the second fiscal 2009 quarter, compared to $4.8 million in the prior-year second quarter. The decrease resulted primarily from declines in professional fees expense and depreciation and amortization expense in the current fiscal year period as compared to the prior fiscal year period. The consolidated net loss for the current 2009 quarter was approximately $(1.9) million, or $(0.04) loss per share (based on 43.4 million weighted average shares outstanding), approximately equal to a loss of approximately $(1.9) million, or $(0.05) loss per share (based on 42.2 million weighted average shares outstanding) for the prior-year second quarter. However, the current quarter's net loss includes the $540,000 write off of deferred acquisition costs, discussed above, versus no comparable amount in the prior fiscal year quarter. For the fiscal 2009 six month period ended March 31, 2009, total revenue was $8.8 million, representing a slight increase in revenues as compared to the comparable fiscal 2008 period. Gross margin for the fiscal 2009 six month period was approximately $6.0 million, reflecting a gross profit margin percentage of 68.1%, compared to gross margin of approximately $6.0 million, reflecting a gross profit margin percentage of 68.7%, for the comparable fiscal 2008 period. Total operating expenses for the fiscal 2009 six month period were approximately $14.8 million, which included a $5.5 million charge for impairment of goodwill and other intangible assets as well as a $540,000 write off of deferred acquisition costs. Excluding the approximately $6.0 million for the impairment loss plus the acquisition cost write off, total operating expenses would have been approximately $8.8 million, an 8.8% decrease compared to total operating expenses of approximately $9.6 million in the comparable prior-year period. The net loss for the fiscal 2009 six month period ended March 31, 2009 was approximately $(9.1) million, or $(0.21) loss per share (based on 43.1 million weighted average shares outstanding) compared to a net loss for the comparable prior-year period of approximately $(3.6) million, or $(0.09) per share (based on 42.2 million weighted average shares outstanding). Onstream utilized approximately $142,000 in cash in operating activities during the three months ending March 31, 2009, as compared to $225,000 used in the prior fiscal 2009 quarter, both numbers before changes in current assets and liabilities. Onstream's cash balance was approximately $506,000 as of March 31, 2009. Mr. Selman continued, "We continue to experience increasing demand for web based communications services, as evidenced by our successful webcasting of 15 Allman Brothers Band pay-per-view concerts for Net Music Communities. This unique event resulted in thousands of fans enjoying the concert from the comfort of their homes, expanding the audience and the revenue potential of these live events. In addition, Georgetown University utilized our innovative iEncode, webcast-in-a-box device, to webcast President Obama's 'A New Foundation for America' speech, which in our view was a validation of the technology. The success of these and other similar events has inspired us to create a new product offering, which we expect to announce in the second half of this fiscal year. This innovative solution will leverage several of our core product offerings, including webcasting and webconferencing along with our suite of digital media services, in a creative way which should encourage cross-utilization of our products." On April 16, 2009 the Company received $750,000 from an entity controlled by one of its largest shareholders, under an agreement which allows for total borrowings of up to $1.0 million. The financing proceeds will be used to advance certain Company initiatives and were also used to pay certain debt and meet other working capital requirements. Mr. Selman continued, "This transaction, which was selected after careful evaluation from three potential financing options, provides us with the capital to consolidate some of our infrastructure, with the goal of reducing our annualized expenses. We are in the process of consolidating equipment into fewer facilities and as a result we expect to recognize cost savings in the fourth quarter. In addition, we will utilize a portion of the funds to build out our infrastructure to support expected growth of our innovative iEncode product. Also, this funding will enable us to develop new products and services." Teleconference Onstream Media will hold a conference call at 4:30 p.m. ET on Monday, May 18, 2009, to discuss its fiscal 2009 second quarter financial results for the period ended March 31, 2009. Interested parties may listen to the presentation live online at http://www.visualwebcaster.com/event.asp?id=59019 or by calling 1-888-437-3184 or 1-201-604-5116. It is recommended to dial in approximately 10 to 15 minutes prior to the scheduled start time. An audio rebroadcast of the conference call will be archived for one year online at http://www.visualwebcaster.com/event.asp?id=59019. About Onstream Media: Onstream Media Corporation ( OTC: ONSM) is an online service provider of live and on-demand internet video, corporate web communications and content management applications. Onstream Media's pioneering Digital Media Services Platform (DMSP) provides customers with cost effective tools for encoding, managing, indexing, and publishing content via the Internet. The DMSP provides our clients with intelligent delivery and syndication of video advertising, and supports pay-per-view for online video and other rich media assets. The DMSP also provides an efficient workflow for transcoding and publishing user- generated content in combination with social networks and online video classifieds, utilizing Onstream Media's Auction VideoT (patent pending) technology. In addition, Onstream Media provides live and on-demand webcasting, webinars, web and audio conferencing services. In fact, almost half of the Fortune 1000 companies and 78% of the Fortune 100 CEOs and CFOs have used Onstream Media's services. Select Onstream Media customers include: AAA, AXA Equitable Life Insurance Company, Bonnier Corporation, BT Conferencing, Dell, Disney, National Press Club, PR Newswire, Shareholder.com (NASDAQ), Sony Pictures and the U.S. Government. Onstream Media's strategic relationships include Akamai, Adobe, eBay, FiveAcross/Cisco and Qwest. For more information, visit Onstream Media at http://www.onstreammedia.com or call 954-917-6655. Onstream Media: Investor Relations: Cautionary Note Regarding Forward Looking Statements Certain statements in this document and elsewhere by Onstream Media are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such information includes, without limitation, the business outlook, assessment of market conditions, anticipated financial and operating results, strategies, future plans, contingencies and contemplated transactions of the company. Such forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors which may cause or contribute to actual results of company operations, or the performance or achievements of the company or industry results, to differ materially from those expressed, or implied by the forward-looking statements. In addition to any such risks, uncertainties and other factors discussed elsewhere herein, risks, uncertainties and other factors that could cause or contribute to actual results differing materially from those expressed or implied for the forward- looking statements include, but are not limited to fluctuations in demand; changes to economic growth in the U.S. economy; government policies and regulations, including, but not limited to those affecting the Internet. Onstream Media undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. Actual results, performance or achievements could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those set forth in Onstream Media Corporation's filings with the Securities and Exchange Commission. TABLES TO FOLLOW

### |